When preparing an IPO, ESG (Environment, Social, Governance) is becoming increasingly important for companies. At the beginning of the year, we have already talked about this development with experts from institutional investors, banks, law firms, rating agencies, and representatives of recently listed companies.

FGS Globalˈs years of vast experience in dealing with IPOs, as well as a row of in-depth interviews with ESG experts from recently listed companies and investment banks, form the foundation for the communicative recommendations below.

Fact-based ESG communication creates credibility

ESG requires a proven track record: before a company goes public, tangible KPIs should already be defined. Building on this, companies should communicate initial milestones and progress towards mid-term goals.

"First get results that can be measured, and only then start talking to each other. It shouldn't be the other way around. Even though the other way is faster, and therefore very tempting, it's not really sustainable in the truest sense of the word."

— Senior Vice President Communications*

In order to counteract accusations of greenwashing right from the beginning, sustainability communication should be transparent and based on comprehensible facts.

"We now always make sure that everything we say has real facts behind it and that there are programs, initiatives, or numbers to back it up, so that this isn't seen as greenwashing."

— Head of Sustainability Investment

*The given quotes were translated. The original language is German.

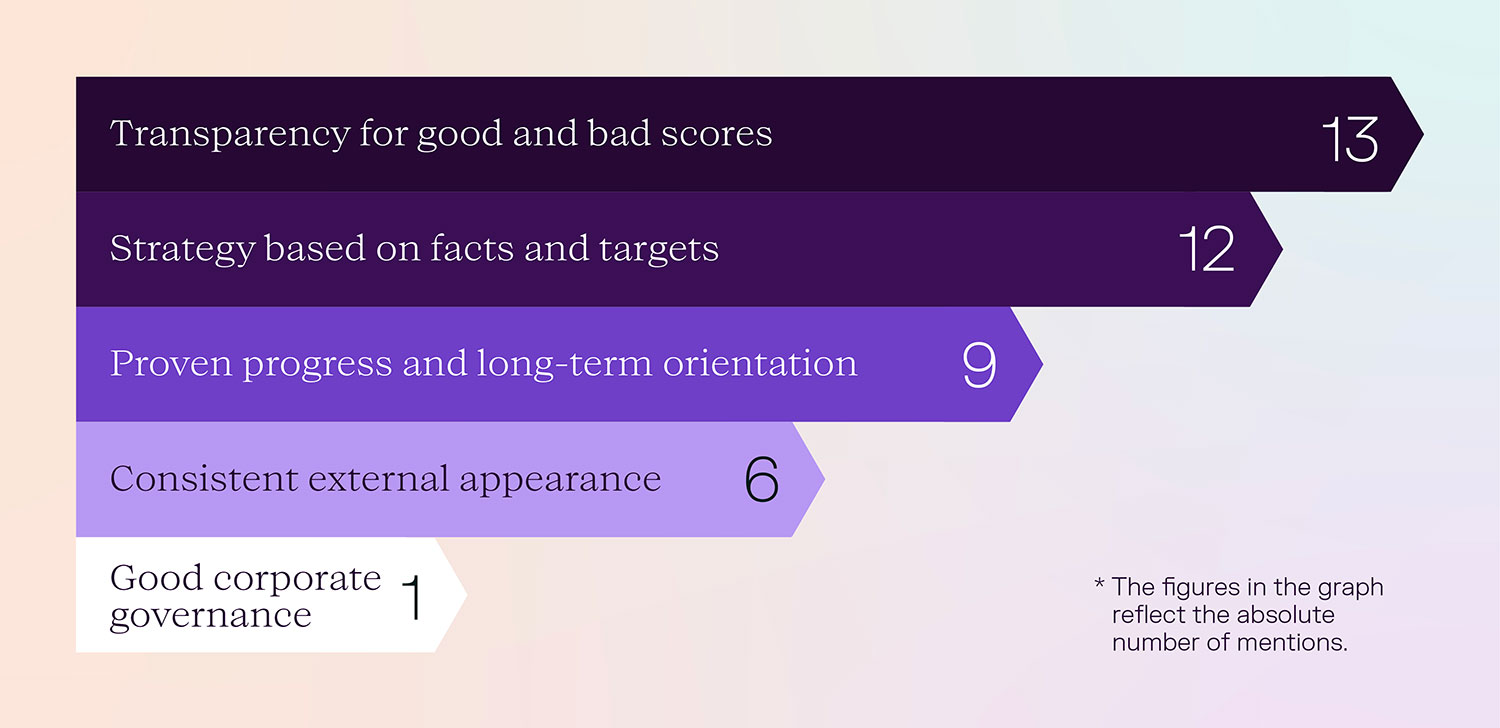

In order to credibly demonstrate their own ESG commitment, companies should take the following success factors into account in their communications:

Convincing storytelling conveys ESG messages

When translating ESG topics into communication formats, a convincing storytelling approach should be applied. A good story helps to put long-term goals into an operational context. To reflect the company’s goal, the storyline has to be adopted towards the company and its ESG strategy.

"It just can't be a gimmick, like a story about trees that were planted. I no longer want to see that. (...) If you want to go public now, you can't use ˈfeel-good storiesˈ to build your ESG image."

— Head of Sustainability & CEO

Companies listed in recent years are increasingly translating their ESG strategies into their own language. For example, by using acronyms or publishing sustainability stories under a specific theme. Successful partnerships with their own stakeholders also play an increasingly important role in the communication of ESG activities.

This shows: issuers must develop a story that is catchy, easy to understand, and close to the heart of the company. Like this, the storyline can comprehensibly classify goals while providing an easy-to-remember narrative. Another expert confirms this with the following statement:

"Before 2020, it didn't exist. It was just a lot of advertising, but it didn't say much about the company. And now it is already communicatively different than if we simply publish a financial report with tables, results or something like that and issue a press release. So, yes, there will be more stories, but they will be based on facts."

— Group Sustainability Manager

Multi-channel approach supports ESG communication

Communicating ESG activities is part of the mandatory program for listed companies. IPO candidates should also engage early on and use various channels for their ESG communication. According to the experts, the following communication channels are beneficial for ESG communication:

Management and employees are important ambassadors

Companies' ESG activities are only credible if all employees understand and support them. According to the experts interviewed, it is negatively perceived when communicated goals are not reflected in the actions of the employees. Management plays a crucial role here, as it must act as a role model to underline the high importance of ESG.

"We do have a central ESG committee, and our CEO is also the Chief Sustainability Officer. So, it was clear from the start that this is the most important thing for us. At the executive level, it's very important, and the whole board is involved."

— Senior Vice President Communication

It is therefore particularly important that ESG activities are anchored throughout the entire company. Therefore, the following should be considered in communication:

Rating agencies are relevant actors

Rating agencies operationalize the initially complex ESG data for companies and investors to get clear facts, KPIs, and trends. The amount of data that is processed depends on the provider, and the methods that are used are not always open to the public. For this reason, reliability of the ratings cannot be guaranteed.

Together with the University of Zurich, the Massachusetts Institute of Technology (MIT) conducted a study called “Aggregate Confusion: The Divergence of ESG Ratings” about how different ESG ratings can be compared in 2022. It becomes clear that the ESG ratings of the biggest agencies have an average correlation of only about 0.61*. Still, the experts think that ESG has a bright future. This is underlined by the fact that the European reporting obligations on ESG are currently being revised. It can be assumed that they will become even more comprehensive from 2024 onwards.

*The correlation coefficient is a statistical measure and can take a value between -1 (perfectly negative correlation) and 1 (perfectly positive correlation). The average correlation of 0.61 of the study can be understood as a moderate positive correlation and indicates that the individual ratings are similar but not yet perfectly unified.

What IPO candidates need to do in ESG communications

Start early to build an ESG track record: an existing ESG track record underpins credibility when going public. It is therefore important to communicate goals and milestones achieved or projects completed before the IPO.

Telling a convincing story makes the difference: the ESG strategy must be embedded in a convincing story to make it more tangible. KPI- and company-related, authentic storylines are helpful to convince stakeholders of the company's ESG activities.

Anchoring ESG among employees: employees are important ambassadors, especially when it comes to ESG. In order to secure their support, the workforce must be actively addressed and involved in ESG activities. It is also important to allay potential fears and be available for questions.

ESG is a matter of leadership: management must communicate ESG internally and represent and exemplify the ESG strategy externally. In this way, companies underpin the role model function of the management team – this can be further strengthened by the business-related integration of ESG into the remuneration system, if necessary, also beyond the legal minimum.

Perception studies with stakeholders: we recommend pre-emptively asking stakeholders which ESG issues are important to them. Like this, potentially risky issues can be identified and addressed in advance.