On January 3, U.S. forces captured and arrested Venezuela’s authoritarian leader Nicolás Maduro and his wife, Cilia Flores, removing them from Caracas to face narco-terrorism charges in New York. Maduro appeared in Manhattan federal court on January 5 for initial proceedings.

Following the operation, President Trump announced that the U.S. would "oversee a transitional framework" in Venezuela, with Vice President Delcy Rodríguez assuming interim authority in Caracas. Venezuelan military posture remains fragmented, though Defense Minister Vladimir Padrino López said “all available capabilities” will be deployed to counter “imperial aggression.” Opposition leader María Corina Machado, whose coalition won 2024's disputed election before being barred from office, has been unable to secure White House backing to lead a new government. Machado told Fox News on January 5 that interim president Delcy Rodríguez "can’t be trusted.”

Maduro’s arrest and its immediate aftermath create near-term risk of a split security apparatus and a scramble for control of Venezuela’s modest but highly coveted revenue engine (PDVSA, ports, exports, the central bank). The downstream implications for policy, business, and markets extend beyond Caracas. Regional governments face immediate recalibrations: Colombia confronts border security and potential migration surges; Cuba reported 32 deaths among personnel in Venezuela during the operation and loses its primary economic lifeline; Mexico condemned the operation and called for UN de-escalation; and Brazil's Lula stated the U.S. crossed "an unacceptable line" and demanded a "vigorous" UN response, despite Brazil’s previous refusal to recognize Maduro's 2024 reelection.

Beyond the hemisphere, geopolitical ramifications are taking shape. The operation tests whether Russian, Chinese, and Iranian support for allied regimes in Latin America and elsewhere has value beyond peacetime economic support. It also has implications for these patrons: China faces exposure on billions in outstanding loans and infrastructure investments while potentially losing its standing as the top beneficiary of Venezuelan heavy crude imports; Russia stands to lose a key Western Hemisphere foothold; and ending the illicit weapons trade between Iran and Venezuela will be a top U.S. priority.

The situation remains fluid, with critical questions emerging across international politics, energy markets, regional stability, and U.S. policy.

FGS Global's geopolitical and policy experts map three dimensions of this evolving situation for governments, businesses, and investors.

1. U.S. intervention in Venezuela tests hemispheric alignment as countries navigate nationalism and economic survival.

If there is one thing everyone across the Latin American political spectrum agrees on, it is that America’s law enforcement and military operation in Venezuela will have deep and long-lasting impacts on regional dynamics at the economic, security, and political levels. For the hemisphere’s most impacted players, the domestic wheels have already started turning.

In Colombia, which shares its longest border with Venezuela, Maduro’s removal reawakened memories of massive refugee influxes and the ghosts of the early 20th century U.S. takeover of the Panamá Canal, and elicited cheers among President Gustavo Petro’s antagonists on the right.

Dissident elements of the former FARC guerrilla group, the National Liberation Army (ELN), and transnational criminal syndicates operate actively in the border region between Colombia and Venezuela. A power vacuum in Venezuela could trigger the spillover of violence into Colombia as factions clash for control of drug routes and illegal mining operations. Following Maduro’s fall, Petro sent additional military reinforcements to the border hoping to preempt a humanitarian crisis and contain security risks.

Many sectors of Colombian society are criticizing the American operation, but Petro's opponents are applauding Trump's move, and some are encouraging the U.S. President to follow through on threats to take aim at Petro next. During this year's presidential election campaign, the political left will try to harness nationalistic sentiments stemming from American intervention threats. The right will likely paint leftists as weak on security and beholden to Chavismo, but that could lose potency if Washington strikes a status quo bargain with the Venezuelan regime.

Brazil also shares a significant border with Venezuela. Leftist President Lula did not recognize Maduro’s electoral victory in 2024. Simultaneously, Lula successfully leveraged nationalism to prop up his political position after Trump demanded Brazil free former president Jair Bolsonaro and imposed heavy tariffs on Brazilian exports as punishment for not following his directive. This helped Lula cast the clash as an assault on Brazilian sovereignty, improving his sagging poll numbers.

The U.S. action in Venezuela gives Lula a bully pulpit to organize regional opposition to Trump’s hemispheric designs, while claiming impartiality given his rejection of Maduro in 2024.

Brazil’s burgeoning trade relationship with China, its largest partner by far, shields the country somewhat from American economic threats. It is also the engine pulling the Southern Common Market, better known as MERCOSUR, giving South America’s largest economy additional regional and global leverage.

In Cuba, the consequences of Maduro’s fall are likely to be devastating, given its heavy dependence on subsidized Venezuelan oil. Even before Maduro’s capture, the island-nation had been suffering massive blackouts and a steady collapse of basic government services, after decades of ideologically rigid economic policies, political repression, and decaying infrastructure. With U.S. sanctions still in place and the Venezuelan lifeline gone, Miguel Díaz-Canel’s regime may face civil unrest and a loss of confidence within the ruling elite.

Historically, when the Cuban regime has entered periods of political and economic difficulty, spikes in U.S.-bound migration have functioned as a pressure release valve. Stricter U.S. immigration enforcement under the Trump Administration changes this dynamic, potentially creating greater domestic instability in Cuba. The loss of Venezuelan support could push the Cuban regime to seek additional backing from Russia and China, both of which already have significant presence on the island (including a Chinese spy station).

For Mexico’s President Claudia Sheinbaum, there are some similarities to Brazil’s Lula, although her position is more vulnerable given Mexico’s proximity to and reliance on the U.S. economy. Nationalism drives politics in a country that still remembers losing half its territory to the United States. But Mexico's deep dependence on American trade puts Sheinbaum in a delicate position.

The developments in Venezuela will test the Mexican president, whose party was friendly with Venezuela’s Chávez regime during her predecessor’s tenure. She also declined to criticize Maduro after he declared himself victor in 2024 despite all available evidence pointing to opposition candidate Edmundo González as the winner.

President Trump’s suggestion that the U.S. forces could take action inside Mexico to combat drug cartels on the heels of Maduro's capture raises the stakes dramatically for Sheinbaum. However, significant American business interests might temper Trump's impulses as companies desperately want certainty after a year dominated by unresolved tariff negotiations. As Democrats focus on affordability as a midterm election campaign issue, actions that impact a major trading partner could spur inflationary pressures as both parties prepare to face voters in November.

These electoral and business dynamics may give Sheinbaum breathing room to navigate shockwaves from Maduro’s capture and thread the domestic nationalistic needle without antagonizing Trump into military action. Volatility defined 2025, so nothing looks assured for the U.S.-Mexico relationship in 2026.

What to watch for:

Military deployments along the Colombian border and security incidents in border regions

Lula's coordination with leftist leaders through MERCOSUR and BRICS

Possible Cuban migration pressure if the island’s economy further deteriorates

Mexican policy shifts ahead of elections and Sheinbaum's balancing act between nationalism and economic dependence

Signs Trump moderates his approach to Mexico as business interests and inflation concerns mount

Regional diplomatic positioning at the OAS and UN

The next 90 days will reveal whether regional powers align with U.S. hemispheric objectives, coalesce around opposition to American intervention, or strike their own paths in future relations with the U.S.

— José Parra is a partner at FGS Global and leads FGS Prospero, the agency’s Latino-focused practice. He is based in Miami.

2. Venezuelan oil and minerals won’t move markets in the near-term, but strategic realignment drives U.S. policy.

Venezuela currently produces around 900,000 barrels of heavy crude oil per day, which is less than 1 percent of global supply. By comparison, U.S. production is around 13.4 million barrels per day (bpd). Venezuelan supply won't move energy markets by itself.

If the U.S. lifts sanctions and its oil embargo, the immediate effects will likely show up in trade flows and refinery configurations. Venezuela’s oil exports will likely reroute from China, the leading importer of its heavy crude since sanctions were imposed in 2019, towards U.S. Gulf Coast refineries, which are purpose built for processing it. This will weaken China's access to discounted barrels, threaten its geographic energy diversification strategy, and reduce its leverage through opaque financing arrangements.

But as many energy analysts have pointed out since the U.S. action in Caracas, reserves are not supply. Venezuela holds the world’s largest proven oil and gas reserves of 303 billion barrels, yet decades of governance failures, infrastructure collapse, and sanctions have destroyed its production capacity. Oil flows on stability and predictability, or as former Secretary of Energy Dan Brouillette put it, “control, logistics, payments, insurance, and confidence in the system surrounding production and exports.” Each of these elements requires intensive restoration in Venezuela before investors get excited, production ramps up, and barrels move. Heavy crude needs diluent – blending with lighter fluids to allow pipeline transport. Aging infrastructure needs repair. And many of the country’s best engineers and skilled workers left years ago. None of this happens overnight.

Incremental growth over 18 to 24 months is possible if existing operators like Chevron can scale quickly. Getting back to pre-collapse levels of production (a peak of 3.7 million bpd in 1970) is more likely a decade-long endeavor, requiring between $7-10 billion annually in sustained investment. Recognizing this, President Trump said on January 6 that "a tremendous amount of money will have to be spent, and the oil companies will spend it, and then they'll get reimbursed by us or through revenue.”

As an immediate measure, President Trump announced on January 6 that Venezuela will turn over 30 million to 50 million barrels of existing oil reserves to the United States. The oil will be transported by storage ships to U.S. docks and sold at market prices, with proceeds controlled by President Trump “to benefit the people of Venezuela and the United States.” While significant as a near-term revenue source—representing roughly 2-3 days of U.S. consumption—this transfer doesn't alter the underlying production capacity challenges or longer-term investment requirements in Venezuela.

Strategic realignment first, resource extraction later

According to Secretary of State Marco Rubio, removing Maduro and reasserting influence in Venezuela and the Western Hemisphere is less about securing tomorrow's barrels and more about displacing adversaries, using energy and resource policy as the tool.

In Venezuela, the administration is operationalizing the Trump Corollary to the Monroe Doctrine, as laid out in the 2025 National Security Strategy: reduce hostile external influence in the region from China, Russia, and Iran; create U.S. investment opportunities; maintain market stability and dominance; and execute a political transition that protects these gains. All of which hinges on stable operating conditions that protect capital.

Tapping Venezuela’s minerals wealth is even more speculative, with longer time horizons

Venezuela's untapped reserves of critical minerals, particularly rare earth elements, nickel, bauxite, and iron ore, are poorly documented. The U.S. Geological Survey’s 2025 Mineral Commodity Summaries do not mention Venezuela as a major reserve country except for certain abrasives. It has significant gold reserves.

Venezuela’s resource-rich Orinoco Mining Arc has extensive illegal mining operations, mostly for gold and possible rare earth elements. Ending illegal mining is expensive and challenging. Mines are remote. Armed groups protect the region. Establishing secure areas where companies can operate safely at Western standards will take time. “The binding constraints today are not geological,” explains Gracelin Baskaran, director of the Critical Minerals Security Program at the Center for Strategic and International Studies. “They are political risk, sanctions exposure, insecurity in mining regions, weak rule of law, and the absence of enforceable contracts.”

Until more is known about reserves and safe operating areas are created, assessing Venezuela's full mineral wealth remains speculative.

What to watch for:

PDVSA leadership appointments and whether a stable authority emerges to enforce rules

U.S. sanctions relief and oil embargo policy decisions

U.S. financing frameworks for Venezuelan oil exploration

Chevron and other operators' production data and scaling timelines

Security incidents in oil-producing regions

Early policy signals on economic openness versus state control

International mining company exploration agreements and feasibility studies

Whether Venezuela's energy and minerals sectors become a model for U.S. hemispheric realignment depends entirely on execution over years. Not weeks.

— Kaveh Farzad is a managing director at FGS Global in Washington, D.C. He previously served in the U.S. Departments of Energy and State during the first Trump administration.

3. For stakeholders, identifying the right signposts over the near-term is critical.

Maduro’s removal has introduced acute political flux and ambiguity in Venezuela and the Western Hemisphere at large. Developments over the next 30 to 90 days will set the trajectory for domestic governance, regional security, energy markets, and geopolitical alignment. Identifying the right signposts now is essential for distinguishing between fragile transition, fragmentation, or a new geopolitical flashpoint.

Three critical developments to monitor immediately

First, the formation or failure of transitional governance. Will a broad-based interim authority gain traction domestically and internationally? Or will power remain concentrated in contested figures like interim President Delcy Rodríguez, who lacks legitimacy among opposition forces, civil society, and international observers?

Early indicators will include the composition of any transitional council, statements from the National Assembly, engagement by electoral authorities, and recognition by the OAS, UN, and key regional states.

Second, international alignment and positioning. The posture of China, Russia, and regional actors like Brazil, Colombia, and Cuba will signal whether Venezuela becomes a cooperative post-conflict reconstruction case or a theater for great power rivalry.

Watch for changes in embassy operations, diplomatic recognition battles, and statements or material actions regarding military, economic, or energy investments. A pivot by China or Russia to protect energy assets, or by Brazil to assert border security, suggests escalating strategic friction.

Third, Venezuela's internal security environment. The disposition of military units, police forces, and armed colectivos will influence whether civic order holds or deteriorates into fragmentation and localized violence.

Monitoring defections, disarmament deals, and unrest in oil-producing regions will be critical to assessing state cohesion. These developments will shape the viability of any governance transition and determine the operating environment for humanitarian actors, investors, and foreign missions.

Scenario planning over the next 6 to 18 months

Venezuela has entered a transitional phase marked by extreme uncertainty in internal political dynamics and external geopolitical pressure. For businesses, governments, and investors operating in or adjacent to this environment, the next 6 to 18 months will be pivotal.

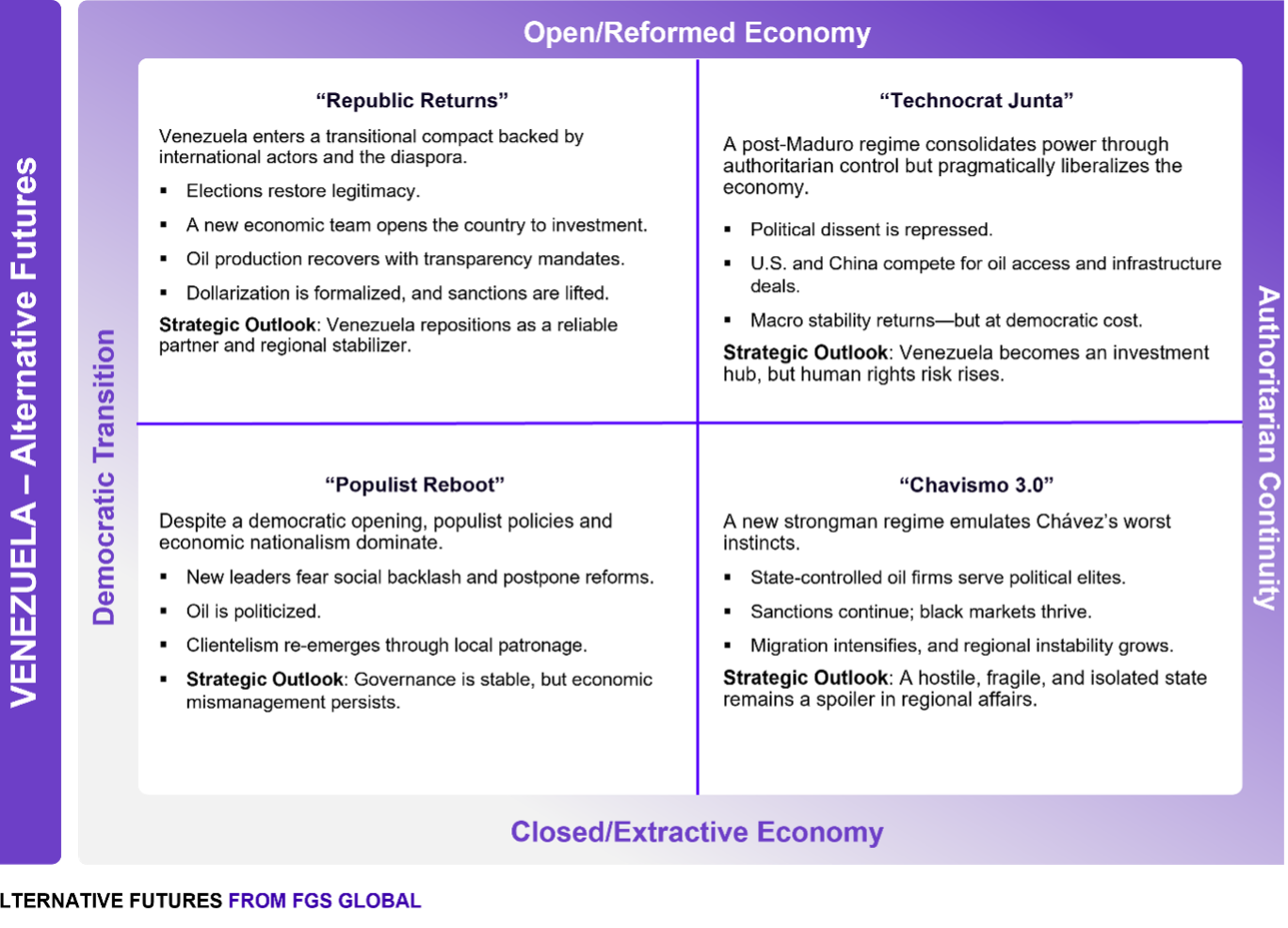

Decision-makers should prepare for a range of plausible futures shaped by two interlocking uncertainties: the nature of Venezuela's political governance and whether it trends toward authoritarian continuity or democratic transition; and the direction of its economic policy and whether it remains closed and extractive or opens toward reform and reintegration.

The following matrix outlines four distinct scenarios emerging from this intersection, each with implications for political risk, regulatory exposure, market access, and strategic engagement.

What to watch for:

Transitional council formation announcements and composition

Statements from Venezuela's National Assembly and electoral authorities

International recognition decisions from OAS, UN, and key regional states (Brazil, Colombia, Mexico)

Chinese and Russian diplomatic posturing and material actions regarding investments

Changes in embassy operations and diplomatic staffing levels

Military defection patterns and leadership realignments

Disarmament deals with armed colectivos and paramilitary groups

— Chad Ensley is a partner at FGS Global in Washington, D.C. He previously worked on national security and technology issues in leadership roles at the CIA, White House, Pentagon, and Department of State.

The bottom line

Maduro’s removal represents a historic inflection point for hemispheric security and U.S. influence in Latin America.

Venezuela's political transition remains dangerously fragmented. No U.S.-backed interim authority has yet emerged. Regional governments are recalibrating positions that must acknowledge both nationalist resistance and economic dependence. China, Russia, and Iran stand to lose a critical Western Hemisphere foothold.

Energy sector recovery will be gradual at best. Production won't move global prices in the near-term, but strategic realignment matters. Restoring pre-collapse output requires significant capital expenditures and will be contingent on stable governance. Critical minerals potential remains speculative until geological surveys are completed and armed groups are cleared from remote mining areas.

The Trump Administration has many tools at its disposal to advance its policy priorities in Venezuela, including sanctions relief, diplomatic recognition, security assistance, and economic assistance. Key variables are execution speed and whether Washington can prevent fragmentation while regional and global powers test U.S. resolve.

2026 will reveal whether Venezuela becomes a model for hemispheric realignment or a cautionary tale about intervention complexity.

This document will be updated as geopolitical events in Venezuela progress. For a deeper analysis of global economic impact and sector-specific implications, please contact FGS Global's Geopolitical Strategy practice.

Last updated: January 7, 2026