On December 11, FGS Global partnered with the Atlantic Council to convene the 2025 Critical Minerals Supply Chains Summit, bringing together senior policymakers, industry leaders, and technical experts to address one of the era’s defining strategic challenges.

"The competition for critical minerals isn’t just about commerce. It’s about security, sovereignty, and the capacity to lead in the technologies that will define the 21st century."

- Capricia Marshall, Partner, FGS Global

The summit brought together leaders from the U.S. Departments of Energy and Interior, Development Finance Corporation, Export-Import Bank, and major mining companies to examine America's minerals security challenge. With China controlling 70% of global extraction and 90% of processing, the discussions centered on reclaiming supply chains through financing innovation, strategic partnerships, technological breakthroughs, and permitting reform.

"Around the world, supply chains have become frontline national security terrain. Every policy choice translates directly into geopolitical leverage."

- Jenna Ben-Yehuda, Executive Vice President, Atlantic Council

The dominant theme was speed. How fast can America build domestic capacity in an era of intensifying geopolitical competition? The answer will determine whether the U.S. can win the AI race, defend national and energy security interests, and avoid vulnerability to supply disruptions.

Here are five things we learned that will dominate this space in 2026:

1. The Trump Administration is moving at emergency speed.

Assistant Secretary of Energy Audrey Robertson and Assistant Secretary of Interior Leslie Beyer outlined the administration's aggressive approach to securing the critical minerals supply chain.

Robertson called the Genesis Mission the "next Manhattan Project," pushing AI-driven innovation with over $500 million in recent funding opportunities.

Beyer detailed how emergency permitting procedures have slashed environmental assessment times from one year to 14 days. She reported that, under the Trump Administration, environmental impact statements now take 24 days instead of two years.

The National Energy Dominance Council, overseen by Interior Secretary Doug Burgum, is coordinating across agencies to provide industry with investment certainty.

DOE's new Office of Critical Minerals and Energy Innovation serves as "one home" for upstream, midstream, and downstream efforts.

The U.S. Geological Survey (USGS) added 10 minerals to the critical minerals list in November 2025, bringing the total to 60 and indicating plans to update the list every two years.

The message from the Trump Administration: permitting reform is a matter of national security.

What to watch for in 2026: Accelerated rollout of the 14 critical mineral projects already fast-tracked under the FAST-41 program, plus new mapping data unlocking domestic reserves across the Bureau of Land Management’s 245 million acres of surface land and 700-million-acre mineral estate.

2. U.S. financing authorities are expanding, but capital gaps persist.

The U.S. government is rapidly expanding its financial toolkit to counter market manipulation created by monopolistic control of critical mineral processing by state-backed competitors.

The DFC, according to Acting Managing Director of Policy for Critical Minerals Tom Haslett, is exploring equity investments and early-stage funding to support U.S. mines and prevent Chinese investment capture.

EXIM Bank Senior Vice President of Origination Sarah Whitten highlighted the launch of the Supply Chain Resilience Initiative to address severe capital deficiency in an industry being completely rebuilt.

The MP Materials partnership with the U.S. Department of War was cited as a groundbreaking model. But panelists acknowledged the challenge: bankers struggle to fund an industry where the entire ecosystem is being reconstructed from scratch. Projects span 2 to 20 years. Public finance alone cannot close the investment gap. Success requires blended finance structures, policy consistency across administrations, and transaction sizes large enough to move the needle on end-to-end supply chains. Cost-sharing requirements ensure all stakeholders have skin in the game.

What to watch for in 2026: New equity mechanisms from DFC, larger EXIM transactions targeting complete supply chains, continued government interventions, and emerging models to attract institutional investors as early successes create momentum.

3. Strategic partnerships are essential for de-risking mineral investments.

Industry leaders and geopolitical experts made clear that collaboration across the value chain and with allied nations reduces risk.

Rio Tinto's gallium project, leveraging Canadian operations and U.S. innovation partners, will meet total U.S. demand for a material currently dominated by Russia. The company's copper projects in Arizona and Nevada include the only U.S. smelter accepting third-party concentrate.

Glencore's $13.5 billion investment in Argentina and global operations demonstrates required geographic diversification.

FGS Global Senior Advisor General (Ret.) Laura Richardson emphasized the link between economic security in Latin America and U.S. national security. China has invested $900 billion in the region. U.S. engagement must focus on infrastructure, democracy support, and environmental standards to counter China's belt-and-road model. Multilateral development banks, particularly the Inter-American Development Bank, must play a larger role. Labor unions and indigenous communities are vital for social license to operate.

One persistent tension emerged: how to maintain reliable partnerships in mineral-rich regions as U.S. public sentiment swings inward, especially with tariffs applying to allies like Canada.

The urgency of allied collaboration became immediately clear the day after the summit, on December 12, when the U.S., led by Under Secretary of State for Economic Affairs Jacob Helberg, launched the Pax Silica Initiative with Japan, Australia, South Korea, the UK, the United Arab Emirates, Israel, the Netherlands, and Singapore to secure critical mineral supply chains and AI infrastructure. Days later, Korea Zinc announced a $7.5 billion processing facility in Tennessee with Pentagon equity participation, the first new zinc smelter in the U.S. since the 1970s and a concrete demonstration that partnership frameworks are translating into commercial action.

What to watch for in 2026: Expanded IDB involvement, bilateral and multilateral finance agreements, and potential Trans-Pacific frameworks countering protectionist pressures.

4. Innovation is security, but scaling remains a challenge.

America excels at innovation but struggles at scaling across the critical minerals value chain.

DOE's Angelos Kokkinos highlighted grants for battery recycling that reduce costs and cycle times. Niron Magnetics' iron nitride technology, supported by DOE funding, offers a path to compete with Chinese-made magnets without rare earths.

Valor's refining innovations provide new processing pathways. Ioneer's advances increased lithium and boron production by 30%. Yet panelists identified a "valley of death" between research and commercial scale where many technologies fail.

Recycling has emerged as a critical domestic source for critical minerals, but the U.S. faces a fundamental challenge: roughly 30,000 metric tons of electronic waste (discarded phones, laptops, batteries, and other devices containing valuable minerals) are exported from the U.S. every month. That material is being sent overseas instead of being collected and recycled domestically to extract critical minerals. Industrial policy must address this upstream collection gap, not just processing technology.

Workforce development emerged as critical. DOE is connecting technical high schools to skilled trades. Companies are hiring from adjacent industries like ceramics, opening the aperture on required capabilities.

Tax investment credits provide long-term certainty. Free markets drive innovation, but strategic government catalysts accelerate deployment.

What to watch for in 2026: DOE pilots moving from lab to commercial operations, new tax credits for critical mineral projects, policy reforms to address upstream collection gaps, and expanded workforce programs.

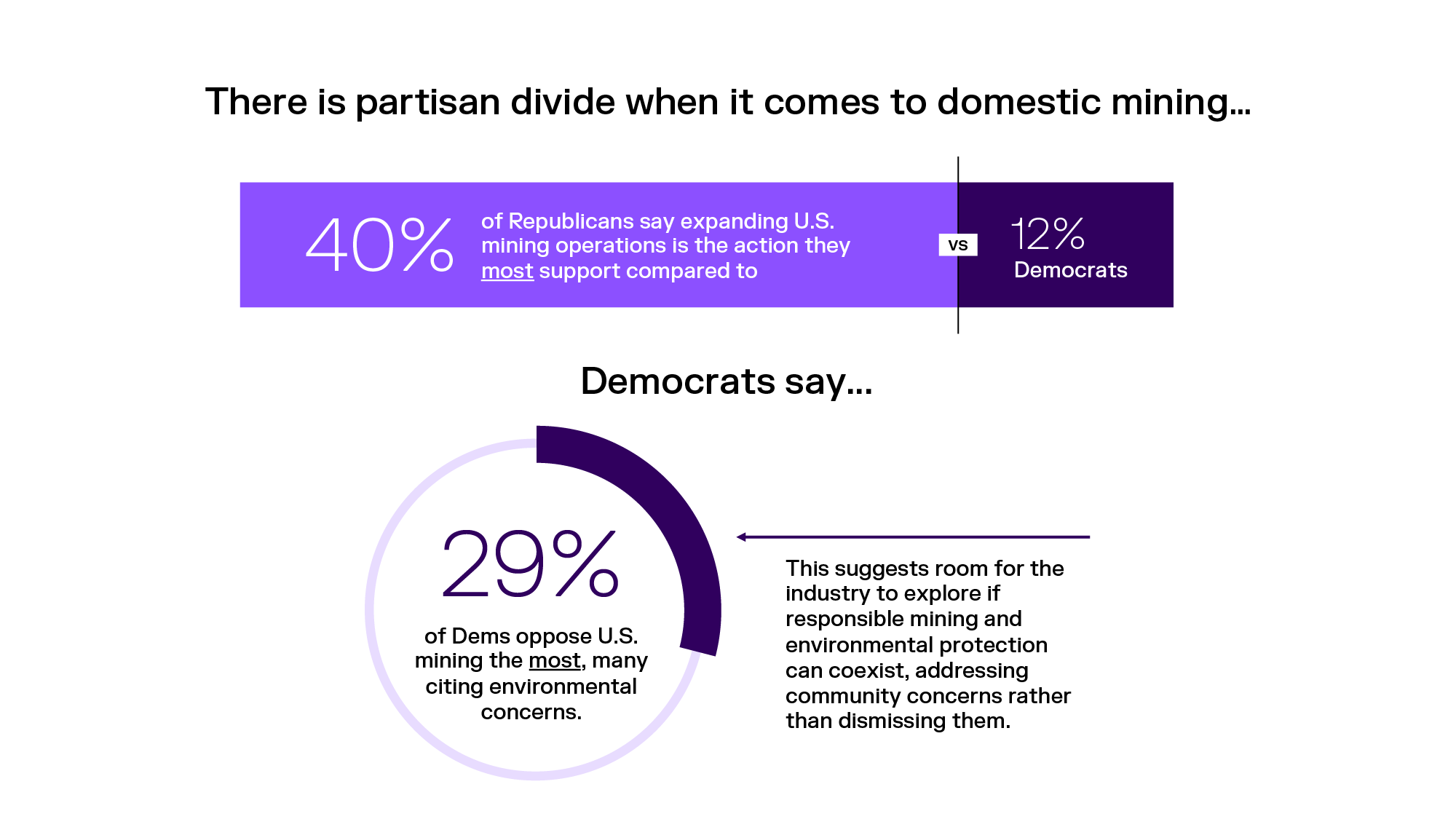

5. Public opinion supports supply chain security, but solutions diverge along partisan lines.

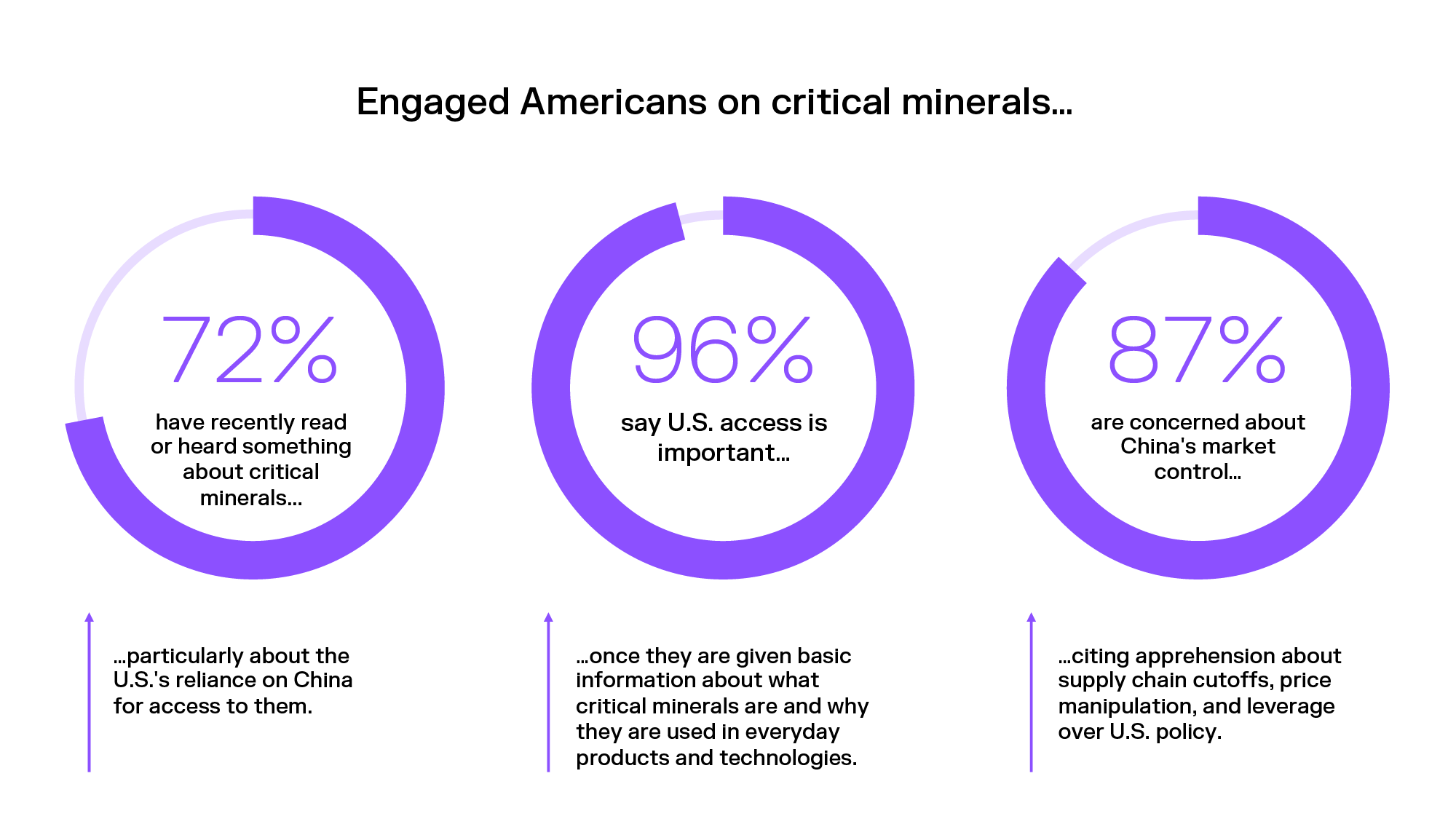

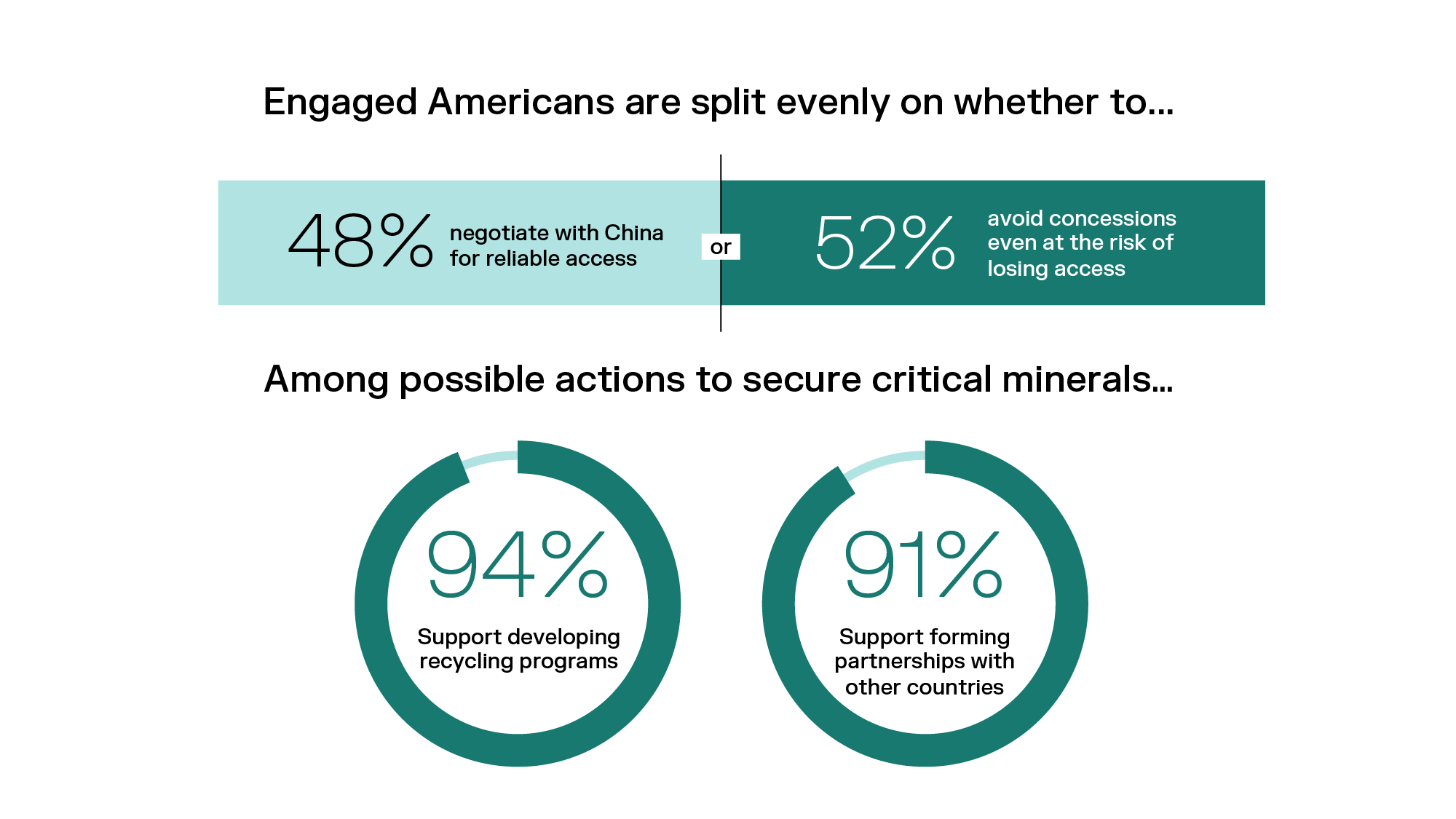

For the U.S. government to sustain the level of involvement it plans across emergency permitting, expanded financing, and industrial policy, it will need durable public support. New research*, conducted by FGS Global’s in-house insights and decision intelligence team and presented by Catharine Ransom, reveals surprising sophistication among engaged Americans on critical minerals.

The research underscores that engaged Americans grasp the strategic stakes, and actions to diversify supply chains and recycle critical minerals have widespread, bipartisan support. The question is whether responsible solutions can shift public opinion on domestic extraction and processing.

The research underscores that engaged Americans grasp the strategic stakes, and actions to diversify supply chains and recycle critical minerals have widespread, bipartisan support. The question is whether responsible solutions can shift public opinion on domestic extraction and processing.

What to watch for in 2026: Mining companies demonstrating responsible practices through transparent operations, community partnerships, and environmental accountability.

The bottom line

The critical minerals policy architecture in the U.S. is taking shape through emergency permitting, expanded financing authorities, and whole-of-government coordination. Industry is investing billions from Argentina to Arizona. Innovation is happening in recycling, substitution, and processing. Yet significant obstacles remain: attracting private capital at scale; maintaining partnerships as political winds shift; bridging the gap between innovation, processing, and deployment; and building public acceptance for domestic mining that meets environmental and governance standards.

As Assistant Secretary Robertson noted, every piece of the puzzle is in the U.S. already: materials, talent, funding, free markets, and government willingness to partner. The question is execution speed. The U.S. is racing to build supply chain resilience before geopolitical leverage becomes geopolitical coercion. Success requires what one panelist called "durability": a multi-generational strategy that survives political transitions and provides industry certainty for multi-billion-dollar investments.

2026 will reveal whether America can move from mine to market faster than adversaries can weaponize supply chains.

In a market where government priorities, geopolitical dynamics, and public opinion are converging, the winners will be those who can align commercial strategy with national and aligned countries’ objectives — and do so visibly and credibly. Businesses that seize this opportunity can secure not only a stronger license to operate, but also a meaningful voice in shaping the future of the supply chains they depend on.

FGS Global will continue its engagement in the critical minerals space in 2026, working with clients and colleagues to define a path forward for businesses and stakeholders across the supply chain seeking to expand their work and influence the critical minerals landscape. Our team across the globe is evaluating geopolitical developments daily, helping to inform policy decisions and government action while helping clients address risk, capture opportunity, and plan investments with confidence.

* Research was conducted using TrendSpotters, FGS Global’s proprietary research tool composed of over 300 U.S. engaged Americans, defined as news attentive, politically aware and civically engaged voters. While we reach nationwide, they are not nationally representative. 207 insights community participants engaged with this activity from December 3-8, 2025. Data should be considered directional in nature, as this research is inherently qualitative.