TikTok lease deal advances with U.S. oversight

State of Play: The White House is finalizing a deal that will allow TikTok to continue operating in the U.S. under a joint venture led by Oracle and Silver Lake. Oracle, co-founded by Trump ally Larry Ellison, will not only safeguard U.S. user data but also license and retrain TikTok’s recommendation algorithm using American data. ByteDance will retain up to a 20% stake with limited board representation, while other high-profile investors—potentially Rupert Murdoch and Michael Dell—may join the consortium. President Trump has signaled optimism after “productive” talks with China’s President Xi, suggesting Beijing could approve the plan soon.

Why it Matters: The deal consolidates major influence over social media and entertainment in the hands of the Ellison family, who already control Paramount Global through David Ellison’s Skydance merger. With Oracle shaping TikTok’s algorithm and Paramount steering TV and film, the Ellisons are emerging as pivotal power brokers at the intersection of tech, media, and politics. Questions linger over whether U.S. users will accept the shift in ownership and influence. Past examples—like Twitter’s rebrand to X under Elon Musk, which drove progressives toward alternatives like Bluesky—show that platform governance can trigger user backlash. TikTok is arguably more culturally entrenched than X, but even subtle changes to its algorithm or ownership narrative could test user loyalty and reshape the social media landscape.

X’s AI algorithm shift puts content control in users’ hands

State of Play: X is shifting to a fully AI-driven content recommendation system aimed at delivering a more tailored experience based on individual interests, reducing exposure to unwanted or divisive material. Users will be able to interact with the AI, known as Grok, to fine-tune their feeds by indicating preferences, providing a new level of control over the content they see.

Why it Matters: X’s shift to a fully customizable AI algorithm challenges the trend toward automated content curation, testing whether users want direct control or prefer passive personalization. By asking users to specify their interests, X collects more detailed preference data, turning user choice into a data-gathering tool. The outcome could reshape how platforms balance user control and data collection, and whether explicit preference sharing becomes the new norm.

Apple emerges as a big winner in Google’s antitrust case

State of Play: A federal judge ruled that Google will not be forced to sell off major products like its Chrome but cannot make exclusive search contracts. This is meant to give competing search engines a fairer shot and reduce Google's dominance in search and digital advertising. Google can still pay Apple an estimated $20-25 billion annually to be the default iPhone search engine, but Apple is now free to also partner with other AI companies like OpenAI. Wall Street sees this as a win-win, with both stocks jumping 3.5-8.5% as Apple gets to keep Google’s payments while gaining flexibility to work with emerging AI search companies.

Why it Matters: This isn’t just about search, it’s about who controls the experiences on the devices we use daily. Apple now has the financial runway and competitive freedom to potentially launch its own AI search product while de-risking through partnerships. This accelerates the shift from Google-dominated search to a fragmented, multi-AI discovery ecosystem where brands must optimize across ChatGPT, Claude, Perplexity, and other AI applications. We are entering a post-Google monopoly era where platform diversification becomes crucial.

To learn more about optimizing for AI-powered search and discovery, click here.

Going bananas: Google’s new AI image tool dominates

State of Play: Google’s Nano Banana (Gemini 2.5 Flash Image) launched in late August and immediately dominated AI image benchmarks, achieving the largest lead in testing history. The tool gained over 10 million new users within days and generated 200 million images, going viral with trends like turning photos into action figures. While Nano Banana includes Google's invisible SynthID watermark for authenticity, critics worry its advanced editing capabilities could “turbocharge visual misinformation” by making realistic image manipulation accessible to anyone through simple text prompts.

Why it Matters: Nano Banana’s launch represents a tipping point where AI image manipulation becomes mainstream and effortless. The digital landscape now demands dual preparedness: leveraging these tools for rapid creative production and cost efficiency, while building proactive defense strategies including crisis response protocols for when brands inevitably become a deepfake target.

Compliance costs turn child protection into competitive advantage

State of Play: Governments and regulators are intensifying pressure on online platforms for stronger child protection measures. The U.S. FTC issued an order to seven major tech companies like OpenAI, Meta, and Alphabet to understand how their AI chatbots potentially harm children and teenagers. At the state level, Mississippi’s age verification law now requires all users to verify their ages before using social platforms like Facebook and Nextdoor. While larger companies are investing heavily in compliance, smaller platforms, like Mastodon, are raising concerns about the cost and feasibility of meeting these new requirements, while Bluesky has blocked access to Mississippi altogether.

Why it Matters: Online platforms are central to how young people communicate, learn, and play, making the stakes around safety and privacy incredibly high. At the same time, age verification creates a compliance cost barrier that often favors big tech while threatening smaller platforms with closure. The shift from voluntary safety measures to enforceable standards is reshaping the digital landscape, potentially consolidating power among giants like Meta and Google who can afford compliance infrastructure, while innovative smaller platforms face the choice of blocking entire regions in the U.S. or shutting down entirely.

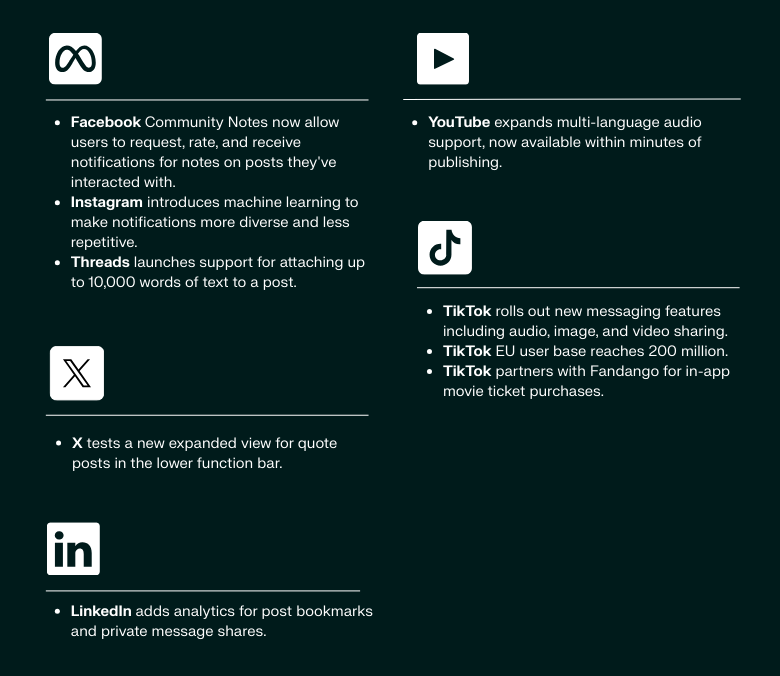

Instagram, LinkedIn, and TikTok emerge as EU growth leaders

State of Play: Data shows strong growth on Instagram, LinkedIn, and TikTok across the EU. Instagram is growing 10 times faster than Facebook, reaching 281.8 million monthly users in early 2025, while Facebook’s growth is slowing or declining in some countries. LinkedIn’s users in the EU rose 14% in the first half of 2025, and its moderation team grew by 52% to handle more reports of harmful content. TikTok’s EU audience passed 200 million users, with the platform also expanding its moderation staff.

Why it Matters: These shifts highlight where people are spending their time online and how social media platforms are evolving to meet new challenges. Instagram’s rapid growth, especially among younger users, contrasts with Facebook’s decline. LinkedIn’s rising importance shows the demand for professional and trusted spaces, backed by stronger moderation efforts. TikTok’s large and engaged audience confirms its role as a key platform for culture and trends. Understanding these changes is crucial for reaching the right audiences, staying relevant, and making smart strategic choices.